You have understood your Networth and your cashflow statement by now, and you have also gone to the future date and really understood how much money that you would possibly want when you retire. [if not, read earlier blogs]

Now,

that you are done with where you stand and where you want to go, let's figure

out what do you need to do to reach your destination in time and with right

quantum on money.

In simple terms your retirement corpus is the Future Value of your Investments today, which typically are: PPF, EPF, Properties, Land Holdings, Fixed Deposits, Mutual Funds, Equity Holdings, Graturity, Annuity, NPS savings etc.

Let's say you had invested in PPF, and you have it for self, your spouse and kid. And here are the holdings

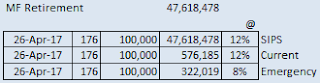

Similarly, you have Mutual Fund Investments - In the form of emergency liquid funds, your current equity holdings and your planned SIPs. Say they value as follows

In simple terms your retirement corpus is the Future Value of your Investments today, which typically are: PPF, EPF, Properties, Land Holdings, Fixed Deposits, Mutual Funds, Equity Holdings, Graturity, Annuity, NPS savings etc.

Let's say you had invested in PPF, and you have it for self, your spouse and kid. And here are the holdings

Similarly, you have Mutual Fund Investments - In the form of emergency liquid funds, your current equity holdings and your planned SIPs. Say they value as follows

And you do have say two properties as well, which value something like below. I am assuming really a low rate of return on properties of around 3-4%. Also, i am assuming you stay with your family in one and have lent out the other one which gives you a rental income of say 30k per month as on today (grows 5% per year)

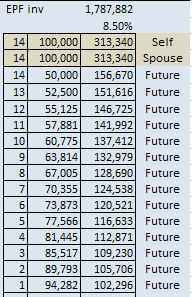

And say you both work and your EPF lumpsums today and future earnings on EPF would be increasing 5% per year.

With all these you would end up having a retirement corpus of 8.8 Cr (but observe that you have also taken immovable assets like properties in to account, which needs to be liquidated if you need their woth to be in banks and withdrawable for usage)

I am repeating, but i am never tired of stating this "Always make conservative estimates for the benefits and generous estimates of your liabilities"

No comments:

Post a Comment